INPEX Vision @2022

Long-term Strategy

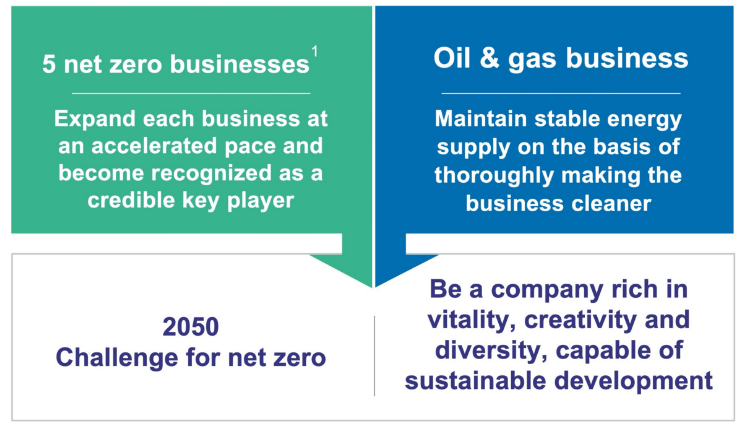

Basic management policy towards a net zero carbon society by 2050

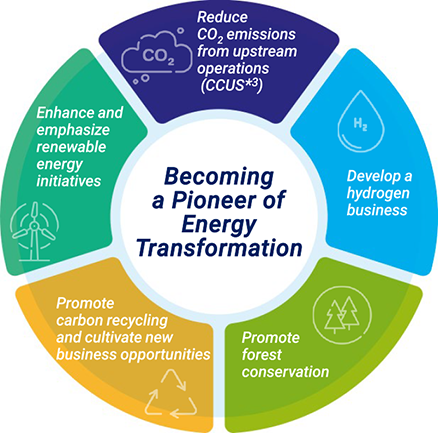

As a pioneer in energy transformation (EX), INPEX will provide a stable supply of diverse and clean energy sources including oil and natural gas, hydrogen and renewable power.

- 11.Hydrogen/ammonia, 2.Reduce CO₂ emissions from oil & gas operations (CCUS)2, 3.Renewable energy, 4.Carbon recycling/new business, 5.Forest conservation

- 2Carbon dioxide Capture, Utilization and Storage

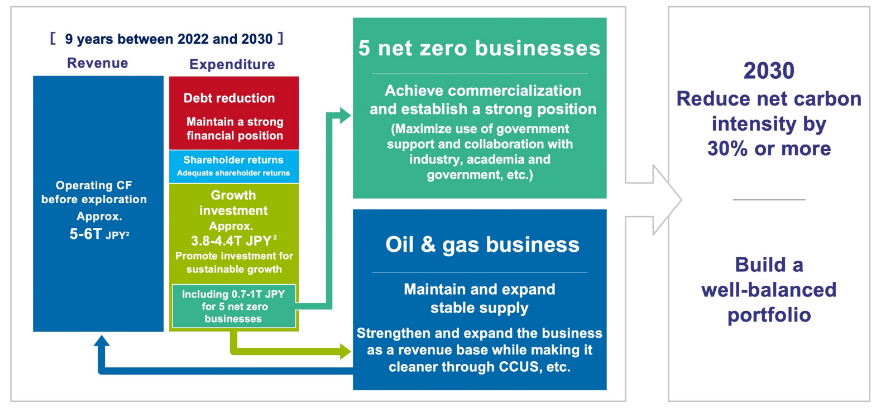

Vision for around 2030

INPEX will transform net zero carbon from an ideal to reality.

Invest up to about 1 trillion JPY in the 5 net zero businesses and aim for these businesses to generate about 10% of operating cash flow1 by 2030

- 1Operating Cash flow before exploration (including Ichthys LNG Pty Ltd, the Ichthys Downstream Incorporated Joint Venture). Cash flow from renewable energy business is estimated based on equity operating cash flow.

- 2Estimates based on the assumption of a Brent oil price of 60-70 USD per barrel

- Note: All figures based on INPEX equity portion

- 1Ammonia volume shown in hydrogen equivalent

- 2Hydrogen that is produced by splitting water using electricity generated from renewable energy

- 3Concept defined at the 2010 United Nations Climate Change Conference that augments REDD (Reducing Emissions from Deforestation and forest Degradation) with the active prevention of forest degradation through forest management and enhancement of carbon stocks through forestation.

- 4Inclusive of midstream and downstream business, etc.

Initiatives in the 5 net zero businesses

- Commercialize 3 or more projects by around 2030 and aim to produce and supply 100 thousand tons or more of hydrogen/ammonia per year

- Aim to become a leading company in the CCUS business by targeting an annual CO₂ injection volume of 2.5 million tons or more in around 2030 and promoting technical development and commercialization

- Aim to secure 1-2 gigawatts of installed capacity, mainly in the offshore wind and geothermal power generation business Become a key player by accelerating business expansion using assets acquired through M&A and other means as a platform

- Promote the adoption of methanation in society and aim to supply about 60 thousand tons1 of synthetic methane per year through INPEX’s natural gas trunk pipeline network by 2030 while pursuing further development

- Strengthen and expand projects aimed at CO₂ absorption through forest conservation, from supportive measures to project participation

Related Links

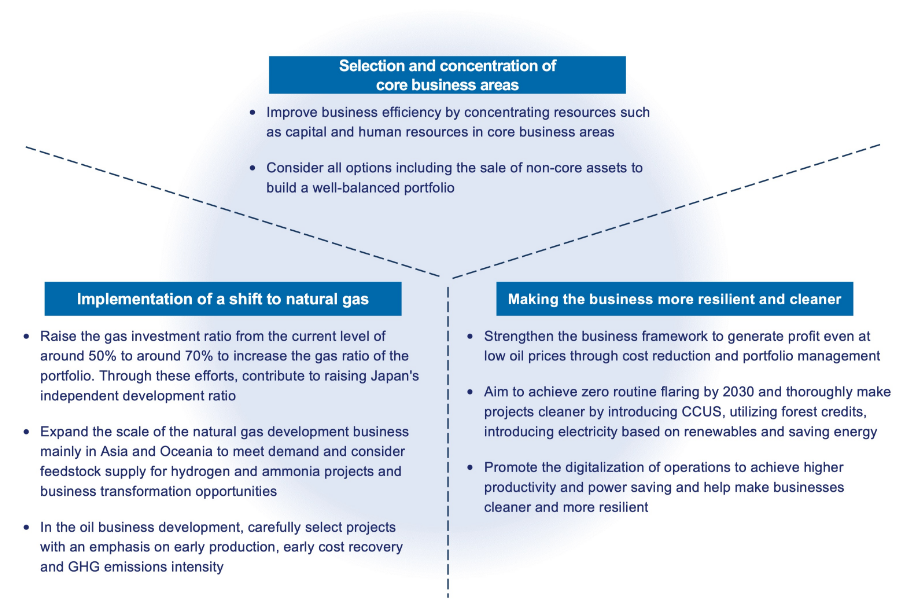

Initiatives in the crude oil and natural gas business

Aim to achieve a stable supply of clean energy by focusing on core business areas, implementing a shift to natural gas and promoting resilience and making the business cleaner in an integrated manner

Centralize business portfolio by setting core business areas

- Focus on Australia, Abu Dhabi, Southeast Asia, Japan and Europe as new core business areas, and improve efficiency by centralizing business assets in these areas

- Expand core business area operations beyond the existing oil & gas business to also include initiatives in the 5 net zero businesses and pursue synergies by leveraging business foundations such as existing business assets, networks and technologies

- Note: Icons on the map indicate that the company currently owns assets or has concrete plans.

Medium-term Business Plan

Positioning of medium-term business plan

Accelerate efforts to realize “Vision for around 2030”

Management targets

- Generate stable revenue and cash flow through stable operations of Ichthys as well as other projects in Japan and around the world

- Secure financial soundness by pursuing debt reduction, expand the 5 net zero businesses of the future and prepare funds for the crude oil and natural gas business

| Index | Targets for FY 20241 | |

|---|---|---|

| USD 60 basis2 | USD 70 basis2 | |

| Net income attributable to owners of parent |

170 billion JPY | 240 billion JPY |

| Operating CF before exploration3 |

600 billion JPY | 700 billion JPY |

| ROE4 | Around 6.0% | Around 8.0% |

| Net debt/equity ratio3 | 50% or less | |

- Note: Sensitivities of crude oil price and foreign exchange fluctuation on net income attributable to owners of parent are disclosed at the time of the annual financial forecast announcements.

- 1Exchange rate assumption: 110 JPY/USD

- 2Oil price per barrel (Brent)

- 3Includes Ichthys downstream Incorporated Joint Venture and differs from financial accounting basis

- 4We will continue to strengthen our business as well as improve management efficiency including share buybacks, etc.

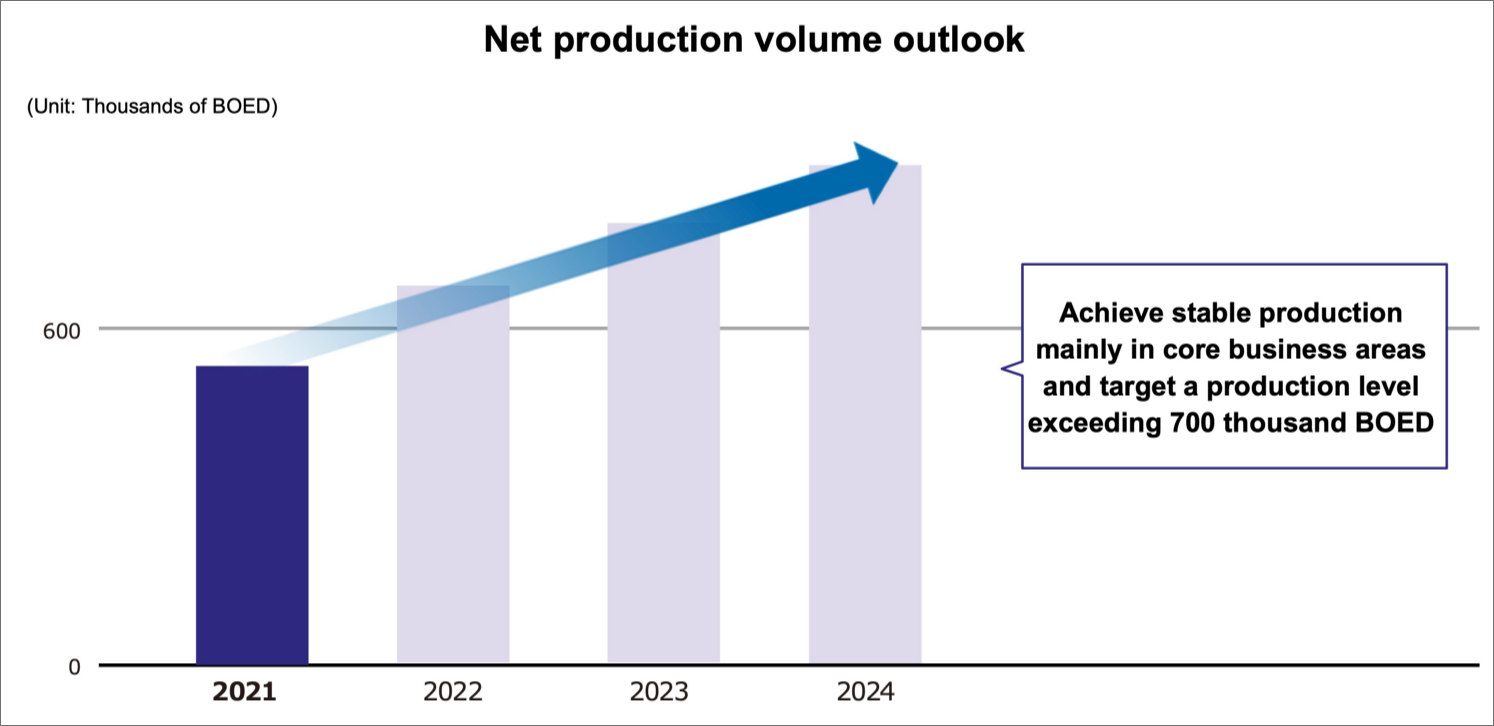

Business targets

- Continue fulfilling our responsibility for the development and stable supply of energy by making our core oil and natural gas business more resilient and cleaner and respond to the energy needs of Japan and the world as a first step towards net zero carbon

| Index | Targets for FY 2024 |

|---|---|

| Net production volume | Level exceeding 700 thousand BOED1 |

| Production cost per barrel | Reduction towards 5 USD per barrel or below |

| Net carbon intensity2 | Reduction of 10% (4.1kg/boe) or more over a 3-year period towards 2030 target3 |

| Safety | Zero major accidents |

- 1Barrels of Oil Equivalent per Day

- 2Net carbon intensity = (equity share emissions volume (Scope 1+2) - offset) / net production volume

- 3Reduction of 2019 net carbon intensity (41.1kg/boe) by over 30%

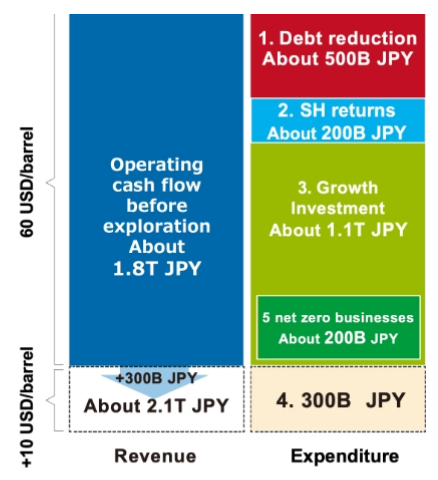

Cash allocation

- Allocate operating cash flow before exploration in the following order :

1. Debt reduction 2. Shareholder returns 3. Growth Investment - Invest about 20% of 3. Growth investment in 5 net zero businesses

Expected cash allocation for 2022-2024 (3-year period)

(Assumptions: Inclusive of Ichthys downstream IJV, 110 JPY/USD exchange rate)

- 1. Debt reduction

-

- Pursue debt reduction of about 500B JPY and achieve a net interest-bearing debt level1 of about 1.5T JPY

→Aim for a net D/E ratio of 50% or less1 and establish a robust financial base

- Pursue debt reduction of about 500B JPY and achieve a net interest-bearing debt level1 of about 1.5T JPY

- 2. SH returns

-

- Aim for annual returns of 60B JPY or more based on 170B JPY net profit level, in line with returns policy (see next slide)

- 3. Growth

-

- Of which about 900B JPY allocated to oil and gas business

Secure level required to sustain stable supply as a key business - Of which about 200B JPY allocated to 5 net zero businesses

To accelerate business, raise investment in 5 net zero businesses to about 20% of total

- Of which about 900B JPY allocated to oil and gas business

- 4. In the event of an oil price increase (60 USD/barrel to 70 USD/barrel)

-

- Operating cash flow to further increase by about 300B JPY at a 70 USD/barrel oil price

- To be used strategically and comprehensively considering business strategy progress, shareholder returns and financial base, etc.

- 1Includes Ichthys downstream Incorporated Joint Venture and differs from financial accounting basis

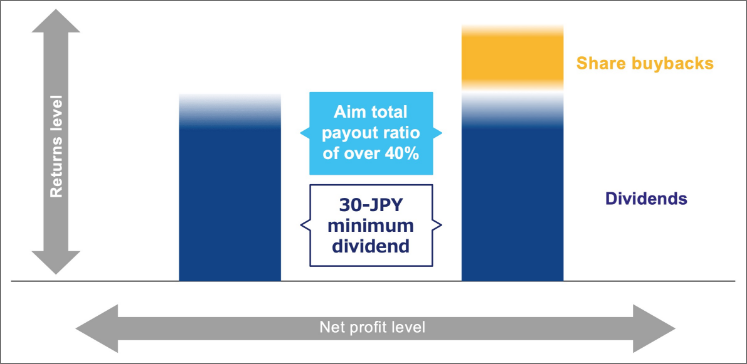

Shareholder returns

Strengthen shareholder returns in accordance with growth in financial performance, with stable dividends as a basis

- Aim for total payout ratio of over 40%

- Implement share buybacks based on business environment, financial base and management conditions, etc.

- Set minimum annual dividend per share of 30 JPY even in case of short-term deterioration of business environment, etc.