Corporate Governance

Our Policy

We continue to enhance our corporate governance approach and activities to fulfill our responsibilities to our shareholders and other key stakeholders and support transparent, fair, timely and conclusive decision-making, with the goal of achieving sustainable growth and increasing corporate value over the medium- to long-term. Furthermore, we formulated and disclosed our Corporate Governance Guidelines for the purpose of ensuring transparency and fairness in decision-making and realizing effective corporate governance through the proactive provision of information. We also revise the guidelines as appropriate in line with governance-related developments.

Basic Policy on Corporate Governance

The mission of the Company is to contribute to the creation of a brighter future for society through our efforts to develop, produce and deliver energy in a sustainable way. Based on this mission, in order to achieve sustainable growth and increase corporate value over the medium- to long-term, the Company fulfills its social responsibilities in cooperation with its shareholders and other stakeholders, and works to enhance its corporate governance for the purpose of conducting transparent, fair, timely, and decisive decision-making.

Corporate Governance Report

INPEX has presented and disclosed the Corporate Governance Report describing basic views on our corporate governance and others in accordance with the regulations for the stock exchange.

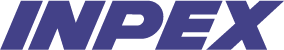

Overview of the Corporate Governance Structure

(The information above is current as of March 27th, 2024, unless otherwise stated.)

To ensure efficient corporate management and highly effective supervision based on its corporate mission, the Company has adopted the structure of a Company with Audit & Supervisory Board Members, whereby Audit & Supervisory Board Members 24 audit the business execution of Directors, who are well versed in their fields. In addition, the Company strives to further increase the agility and efficiency of its management by introducing an Executive Officer System aimed at further strengthening its business operation system in order to respond accurately and quickly to a rapidly changing management environment and the expansion of its business activities.

The Company frequently engages in important negotiations with national governments and international energy companies. This necessarily requires internal Directors and executive officers that have knowledge, expertise and international experience relating to the Company’s business and both a sound knowledge of the Company and their particular fields of expertise. Internal Directors in principle hold concurrent position as executive officers. By adopting this organizational structure, the Company’s Board of Directors is better placed to make decisions on the execution of business in an efficient manner. At the same time, this structure helps to ensure the effective supervision of management.

The Company has appointed five of its ten members of the Board of Directors from Outside the Company to enhance the transparency of management and strengthen the effective supervisory function of the Board of Directors. This also aims to utilize for management objective perspectives which are different from the ones of insiders: those Directors from outside the Company are, from their independent standpoint, expected to provide advice based on their own knowledge and experience, monitor the management and conflict of interest transactions, and to appropriately represent the views of stakeholders to the Board of Directors.

The Company has selected Outside Directors from external persons who have extensive experience and wide-ranging insight as corporate managers, academics, or other specialists in the resource/energy industry, or in fields of finance or legal affairs, etc.

Furthermore, four of the five Audit & Supervisory Board Members are Outside Audit & Supervisory Board Members. In addition, in order to strengthen the audit function by ensuring independence of Audit & Supervisory Board Members and efficiency of audits, an Audit & Supervisory Board has been established pursuant to laws and regulations. Further efforts of the Company include the placement of employees in Audit & Supervisory Board Members’ Office as an organization dedicated to assist operations by Audit & Supervisory Board Members, and efforts in strengthening the coordination between the internal audit department(Audit Unit), Outside Directors, and accounting auditors.

Overview of the Corporate Governance Structure

| Organizational structure | Company with Audit & Supervisory Board Member | |

|---|---|---|

| Directors | Number of directors as stipulated by the Articles of Incorporation | up to 16 |

| Number of directors (number of outside directors) | 10 (5) | |

| Term of office | 1 year | |

| Audit & Supervisory Board Members | Number of Audit & Supervisory Board members as stipulated by the Articles of Incorporation | up to 5 |

| Number of Audit & Supervisory Board members (number of outside Audit & Supervisory Board members) | 5 (4) | |

| Term of office | 4 years | |

| Number of independent directors and auditors | 9 (5 outside directors, 4 outside Audit & Supervisory Board Members) |

|

| Other | Issuance of a Class A Stock to the Minister of Economy, Trade and Industry | |

[1] Directors and the Board of Directors

The responsibilities of the Board of Directors shall be to fully exercise its supervisory function, secure fairness and transparency in management, and ensure sustainable growth and increase corporate value over the mid- to long term through implementation of effective corporate governance, with recognition of its fiduciary responsibility to shareholders. The Company’s Board of Directors comprises ten members, five of whom are Outside Directors. In addition to a monthly meeting, the Board of Directors meets as necessary in order to discuss and determine matters concerning management strategy, important business execution, and also supervises the execution of duties by Directors. The term of office of Directors shall be one year to enhance the ability of Directors to respond to changes in the global management environment in a timely manner and to further clarify management responsibilities.

[2] Executive Committee and Executive Officer System

From the perspective of accelerating the decision-making process related to the execution of business, the Company has established the Executive Committee as a body to carry out agile decision-making for matters not required to be resolved at the Board of Directors and hold discussions conducive to the decision-making by the Board of Directors. The Executive Committee meeting is held once a week and as necessary. The Executive Committee is comprised of full-time Directors, Executive Officers as Senior Vice President and other Executive Officers who are required by the chairman and appointed by the Executive Committee. The number of the current committee members is 15. Considering the efficiency of proceeding, the committee is chaired by Representative Director, President & CEO who has the widest knowledge of business of the company.

In order to respond accurately and quickly to a rapidly changing management environment and the expansion of the Company’s business activities, the Company has introduced an Executive Officer System to clarify the business execution system and establish an agile and efficient management structure through the delegation of authority. The term of office of Executive Officers shall be one year to further clarify executive accountabilities.

[3] Audit & Supervisory Board Members and the Audit & Supervisory Board

The Company has adopted an audit & supervisory board members system. The Company’s Audit & Supervisory Board is comprised of five Audit & Supervisory Board Members, four of which are Outside Audit & Supervisory Board Members. The Audit & Supervisory Board Members possess considerable knowledge and experience in the Company’s business, as well as in fields related to finance, accounting, legal affairs and others, and leverage these skills in performing auditing activities for the Company. The Company has set up the Audit & Supervisory Board Members’ Office as an independent organization from the business execution departments and shall deploy four dedicated employees possessing the necessary and appropriate knowledge and ability to assist the Audit & Supervisory Board Members with auditing duties in order to enhance the effectiveness of audits by Audit & Supervisory Board Members.

・Activities of the Audit & Supervisory Board

In principle, the Audit & Supervisory Board meeting is held on a monthly basis on the same date as the Board of Directors meeting. Additionally, the Audit & Supervisory Board has ad hoc meetings as necessary. The Audit & Supervisory Board resolves statutory matters including audit plans and receives reports on the execution of duties from the internal audit department (Audit Unit) and the accounting auditor, Ernst & Young ShinNihon LLC, and requests clarifications if necessary. Further, Audit & Supervisory Board Members share information they gather through their individual auditing activities and have discussions as necessary.

・Activities of Audit & Supervisory Board Members

The Audit & Supervisory board members, according to the auditing standard adopted by the Audit & Supervisory Board and in compliance with the audit plan, maintain close contact with Directors, the internal audit department(Audit Unit) and the dedicated employees, gather information, develop an auditing environment and attend strategic meetings including Board of Directors meetings, and where necessary, seek clarifications or provide statements on agenda items. Regular meetings with representative Directors are held for the purpose of exchanging opinions and monitoring the implementation of management policies as well as the development and operation of internal control systems. Further, meetings with Directors are held regularly for the purpose of conducting hearings on the status of business executions with Directors in charge of the Company’s respective business divisions. Additionally, full-time Audit & Supervisory Board Members attend regular and ad hoc Executive Committee meeting and ad hoc Compliance Committee meetings, gather information through reviewing internal approval documents, and if necessary, request clarifications from business divisions. Further, full-time Audit & Supervisory Board Members receive reports on internal whistle-blowing cases from the Director in charge of compliance.

[4] Internal Audit

The Audit Unit was established under the direct supervision of the President & CEO (with 14 dedicated staff as of March 27, 2024) as an internal audit department independent of the divisions involved in the execution of the Company’s business. The Audit Unit verifies the design and operational status of internal controls across all management activities of our company and its group companies through internal audits, identifying areas for improvement. These areas for improvement are followed up until their correction is completed, and significant matters are shared with all departments within the company, contributing to the maintenance and enhancement of the effectiveness of internal control. The Audit Unit follows up these areas for improvement until their correction is completed, and shares the significant matters among them with all departments of the company.

In developing annual audit plans, the Audit Unit discusses and exchanges opinions with the Audit & Supervisory Board Members, and after obtaining the President & CEO's approval, makes reports to the Board of Directors. Additionally, the results of the internal audits are reported at meetings of the Board of Directors / Audit & Supervisory Board and to the President & CEO, full-time Audit & Supervisory Board Members, and are shared with accounting auditors.

To ensure the expertise of those involved in internal audits, the Audit Unit encourages the acquisition of qualifications related to internal audits and active participation in external training courses, and it has several Certified Internal Auditors (CIA). A "skill map" outlining the abilities and experiences required for conducting internal audits is created and updated for each member, and is used for planning education and training programs, and assigning tasks according to each person's experience and expertise. Furthermore, to continuously improve the quality of internal audits, it is stipulated that an external quality assessment by an independent assessor is to be conducted at least once every five years.

[5] Accounting Audit and Auditor Compensation

In accordance with the Companies Act and the Financial Instruments and Exchange Act, we accept accounting audits from Ernst & Young ShinNihon LLC. The amount of auditor compensation is determined in total based on the audit plan and the number of auditing dates, after obtaining approval from the Audit & Supervisory Board.

Compensation Paid to the CPAs and Related Parties

| Name of the CPA firm | Ernst & Young ShinNihon LLC |

|---|---|

| Names of the CPAs | Kazuhiko Yamazaki, Satoshi Takahashi, Mikio Shimizu,Kentaro Moronuki |

| Accounting audit members | 61 CPAs, 7 persons who passed an accounting exam,etc., and 35 others |

| Compensation for auditing services | ¥506 million (INPEX: ¥411 million; Consolidated subsidiaries: ¥95 million) |

| Compensation for non-auditing services | ¥8 million (INPEX: -; Consolidated subsidiaries: ¥8 million) |

[6] Internal Committees

The Nomination and Compensation Advisory Committee and the INPEX Advisory Committee have been established as advisory bodies to the Board of Directors, and the Compliance Committee, Sustainability Committee, Corporate HSE Committee, Information Security Committee, and INPEX Value Assurance System(IVAS) Committee have been established as various committees related to business execution. The outline of each committee is as follows.

-

1

Nomination and Compensation Advisory Committee

Number of meetings held in FY2023: 6 -

The Nomination and Compensation Advisory Committee was established in January 2017 with the aim of strengthening the independence, objectivity and accountability of the Board of Directors’ functions relating to the nomination and compensation of Directors. This committee deliberates on the nomination and compensation of Directors, etc. and reports its findings to the Board of Directors. At the extraordinary Board of Directors meeting held on March 26, 2024, one in-house Directors and three independent Outside Directors were appointed. In addition, an independent Outside Director has been appointed as the chairperson.

-

2

INPEX Advisory Committee

Number of meetings held in FY2023: 2 -

The INPEX Advisory Committee was established in October 2012 with the aim of enhancing corporate value and corporate governance. Comprised of external experts, the committee provides the Board of Directors with multifaceted and objective counsel and recommendations across a wide range of areas including international political and economic outlook, prospects for the energy sector, ideal management strategies as a global company, and ways to strengthen corporate governance. The committee is comprised of experts from Japan and overseas, all of whom possess a wide range of knowledge related to this field, including university professors.

-

3

Compliance Committee

Number of meetings held in FY2023: 4 -

The Compliance Committee was established in April 2006 with the aim of promoting compliance initiatives across the entire Group. The committee, chaired by the Director in charge of compliance, is comprised of the Senior Vice Presidents of the standing organizational units, and deliberates on basic policies and important matters of the Group relating to compliance and manages the implementation status of compliance activities.

-

4

Sustainability Committee

Number of meetings held in FY2023: 3 -

The Sustainability Committee was established in April 2012 (originally named as CSR Committee and changed its name to Sustainability Committee in November 2021) with the aim of better fulfilling the Company’s corporate social responsibilities and promoting activities that contribute to the sustainable development of society. The committee is chaired by the Representative Director, President & CEO and is comprised of Representative Director, Chairman; Senior Vice President, General Administration; Senior Vice President, Corporate Strategy & Planning; Chairperson of the Compliance Committee; and Chairperson of the Corporate HSE Committee. The committee discusses basic policies regarding sustainability, important matters pertaining to sustainability implementation including without limitation to corporate governance and climate change response.

-

5

Corporate HSE Committee

Number of meetings held in FY2023: 10 -

The HSE Management System was established on September 17, 2008 to promote measures for occupational health and safety and the environment in accordance with the HSE Management System Regulations established by our company. This committee is chaired by the officer in charge of the HSE, and the committee members are the general manager of the permanent organization and our company officers, who deliberate on policies and important matters related to the HSE.

-

6

Information Security Committee

Number of meetings held in FY2023: 2 -

The Information Security Committee has been established since November 2007 for the purpose of examining and deciding various measures necessary for maintaining, managing and strengthening information security. The Committee is chaired by an officer in charge of information systems, deliberates on basic policies and important matters related to information security, and manages measures to respond to incidents related to information security and prevent their recurrence.

-

7

INPEX Value Assurance System Committee

Number of meetings held in FY2023: 28 -

INPEX Value Assurance System (IVAS) Committee has been established since May 2014 to confirm the readiness of major projects in which our company participates and to contribute to our company's decision-making regarding the enhancement and promotion of project value. This Committee, headed by(Senior Vice President, Technical Headquarters, conducts cross-organizational technical assessments of new projects and existing projects in each phase of exploration, evaluation, and development.

[1] Outside Directors

Regarding the appointment of outside directors, we believe that it is important to comprehensively consider a variety of factors. These factors include the validity of business decisions and consideration of their effectiveness, expertise and objectiveness in the oversight function in addition to the perspective of independence. As corporate managers, academics or other specialists, the Company’s five outside directors possess broad knowledge and many years of experience in such fields as resource/energy industry, finance and legal matters.

[2] Outside Audit & Supervisory Board Members

When appointing outside Audit & Supervisory Board members, we believe that it is important to comprehensively consider factors such as independence, efficacy in the oversight function and professionalism. Four of the Company’s five Audit & Supervisory Board members are appointed from external sources. Audit & Supervisory Board members possess a rich knowledge and experience in the Company’s business as well as in such fields as finance, legal affairs and management, which they use when performing auditing activities for the Company.

[3] Independence of Outside Directors and Outside Audit & Supervisory Board Members

The Company has reported all outside directors and outside Audit & Supervisory Board members as independent directors as defined by Tokyo Stock Exchange, Inc. As a part of efforts to comply with the Corporate Governance Code, INPEX has formulated independence standards for outside directors and outside Audit & Supervisory Board members taking into consideration the independence standards and qualifications for independent directors issued by the Tokyo Stock Exchange. The Company determines the independence of outside directors, including major shareholders and business partners that do not fall within the scope of these standards.

Outside Directors/Outside Audit & Supervisory Board Members: Concurrently Held Positions and Reason for Appointment

| Name | Independent director/auditors | Significant concurrently held positions | Reason for appointment | Attendance at board meetings for the year ended December 31, 2023 | |

|---|---|---|---|---|---|

| Outside Directors | Jun Yanai | ✓ | Advisor of Mitsubishi Corporation | Mr. Jun Yanai has been appointed as an Outside Director since it has been determined that he is able to appropriately execute his duties as Outside Director due to being expected to provide supervision of the execution of business from an international perspective and the necessary comments and suggestions, etc. in the meetings of the Board of Directors, etc. primarily by utilizing his experience as a corporate executive and abundant experience and insight in the resource and energy industry. | Board of Directors meetings 16/16 |

| Norinao Iio | ✓ | - | Mr. Iio has been appointed as an Outside Director since it has been determined that he is able to appropriately execute his duties as Outside Director due to being expected to provide supervision of the execution of business from an international perspective and the necessary comments and suggestions, etc. in the meetings of the Board of Directors, etc. primarily by utilizing his experience as a corporate executive and abundant experience and insight in the resource and energy industry. | Board of Directors meetings 16/16 | |

| Atsuko Nishimura | ✓ | Outside Director, TAISEI CORPORATION | Ms. Nishimura has been appointed as an Outside Director since it has been determined that she is able to appropriately execute her duties as Outside Director due to being expected to provide supervision of the execution of business from a diverse and global perspective and the necessary comments and suggestions, etc. in the meetings of the Board of Directors, etc. by utilizing her abundant experience as a diplomat and extensive insight on international conditions, in addition to expert knowledge as a university professor. | Board of Directors meetings 16/16 | |

| Tomoo Nishikawa |

✓ | - | Mr. Nishikawa has been appointed as an Outside Director since it has been determined that he is able to appropriately execute his duties as Outside Director due to being expected to provide supervision of the execution of business from a diverse and global perspective and the necessary comments and suggestions, etc. in the meetings of the Board of Directors, etc. by utilizing his abundant experience and insight as an international attorney, in addition to knowledge in a variety of fields such as expert knowledge as a university professor. |

Board of Directors meetings 16/16 | |

| Hideka Morimoto | ✓ | Outside Director, Takasago Thermal Engineering Co., Ltd. | Mr. Hideka Morimoto has been appointed as an Outside Director since it has been determined that he is able to appropriately execute his duties as Outside Director due to being expected to provide supervision of the execution of business from a sustainability (ESG) perspective and the necessary comments and suggestions, etc. in the meetings of the Board of Directors, etc. by utilizing his abundant experience and insight on the environment and energy policy developed through his career in the Ministry of the Environment, in addition to expert knowledge as a university professor. | Board of Directors meetings 16/16 | |

| Outside Audit & Supervisory Board Members | Toshiya Tone |

✓ | - | Mr. Tone has been appointed as an Outside Audit & Supervisory Board Member since he possesses extensive experience and a broad range of insights in the fields of finance and taxation | Board of Directors meetings 12/12 and Audit & Supervisory Board meetings 13/13 |

| Kenichi Aso |

✓ | - | Mr. Aso has been appointed as an Outside Audit & Supervisory Board Member since he possesses extensive experience and knowledge in international financing and finance, etc. | Board of Directors meetings 12/12 and Audit & Supervisory Board meetings 13/13 | |

| Mitsuru Akiyoshi |

✓ | Outside Director, Concordia Financial Group, Ltd. | Mr. Akiyoshi has been appointed as an Outside Audit & Supervisory Board Member since he possesses extensive experience and knowledge in on finance and management, etc. | Board of Directors meetings 16/16 and Audit & Supervisory Board meetings 17/17 | |

| Hiroko Kiba |

✓ | Outside Director, Central Japan Railway Company | Ms. Kiba has been appointed as an Outside Audit & Supervisory Board Member since she possesses extensive experience and knowledge as a freelance newscaster and university instructor. | Board of Directors meetings 16/16 and Audit & Supervisory Board meetings 17/17 |

- ※1Mr. Toshiya Tone and Mr. Kenichi Aso of Audit & Supervisory Board Members were elected (newly appointed) at the 17th Annual General Meeting of Shareholders held on March 28, 2023, and Mr. Mitsuru Akiyoshi and Ms. Hiroko Kiba of Audit & Supervisory Board Members were elected (reappointed) at the same Annual General Meeting of Shareholders.

Compensation for directors (excluding outside directors) consists of basic compensation, which is paid according to the duties of each director; bonuses, which serve as a short-term incentive; and stock-based remuneration, which gives a medium- to long-term incentive. Compensation for outside directors is limited to basic compensation only from the perspective of independence of their duties.

Bonuses as a short-term incentive is linked to the Company’s net income attributable to owners of parent (hereinafter “net income”) and cash flows from operating activities before exploration, which are our major financial indices, as well as a safety index (zero major accidents) that serves as a non-financial index. The amount of compensation is calculated based on the evaluation weights in the table below according to the degree of achievement of these targets, and the final amount of compensation fluctuates within the range of 0% to 200%.

KPIs used to calculate bonuses for directors (excluding outside directors)

| Bonus KPI | Evaluation weight | |

|---|---|---|

| Financial indicators | Net income | 45% |

| Cash flows from operating activities before exploration | 45% | |

| Non-financial indicators | Safety indicators (zero major accidents) | 10% |

Stock-based remuneration as a medium- to long-term incentive is paid to directors (excluding outside directors and non-residents of Japan) and executive officers (excluding non-residents of Japan) (hereinafter collectively the “eligible directors and officers”). This remuneration system is called the Board Incentive Plan Trust, and it combines performance-based elements aimed at raising the awareness among the eligible directors and officers of their contribution to the Company’s medium- to long-term business performance and enhancement of corporate value, and fixed elements aimed at strengthening the awareness among the eligible directors and officers of sharing interests with shareholders through the ownership of the Company’s shares. The performance-based portion of the stock-based remuneration is linked to the Company’s key financial indices set forth in the Medium-term Business Plan, namely, net income, cash flows from operating activities before exploration, ROE and total payout ratio, as well as to the production cost per barrel and net carbon intensity, which are our major non-financial indices. The amount of compensation is calculated based on the evaluation weights in the table below according to the degree of achievement of these targets, and the final amount of compensation fluctuates within the range of 0% to 200%. In the event that any of the eligible directors and officers commit a significantly improper or violating act, the Company may cancel or forfeit their right to receive the Company’s shares or other forms of compensation under the system (malus) and demand the return of cash corresponding to the Company’s shares or other forms of compensation already delivered to them (clawback).

KPIs used to calculate performance-linked stock-based remuneration for directors (excluding outside directors) and executive officers

| Stock-based remuneration KPI | Evaluation weight | |

|---|---|---|

| Financial indicators | Net income | 30% |

| Cash flows from operating activities before exploration | 30% | |

| ROE | 10% | |

| Total payout ratio | 10% | |

| Non-financial indicators | Production costs per BOE | 10% |

| Net carbon intensity | 10% | |

Regarding the compensation for directors, the Nomination and Compensation Advisory Committee deliberates on major matters in accordance with the policy for determining the amount and calculation method of compensation, etc. for directors and the details of compensation, etc. for individual directors, and submits a report to the Board of Directors. Based on the report from the Committee, the Board of Directors decides on the compensation for directors within the limits and terms approved at the general meeting of shareholders. The amount of compensation to be paid to each director by type is decided by the Representative Director, President & CEO, who shall be entrusted to do so by a resolution of the Board of Directors, in accordance with the deliberation by the Nomination and Compensation Advisory Committee, a majority of whose members are outside officers, including independent outside directors.

Considering the external environment, social and economic trends, and other factors surrounding the Company, the Nomination and Compensation Advisory Committee will carefully deliberate on the appropriateness of the target values and calculation method for compensation and issue a report, based on which necessary adjustments may be made to the amount of compensation for each director by a resolution of the Board of Directors.

The adequacy of compensation for directors is verified by the Nomination and Compensation Advisory Committee after an external compensation research organization examines and analyzes the level of compensation for each position in a peer group of companies of the same size and similar industries.

The ratios of the basic compensation, bonuses and stock-based remuneration for inside directors are generally balanced to follow the principle that the higher the position held by a director is, the higher the weight of his or her performance-based compensation (bonuses and stock-based remuneration) is.

Compensation for Directors and Audit & Supervisory Board Members in FY2023 (Million JPY)

| Classification | Total amount of compensation paid | Total compensation by type | Number of eligible directors and Audit & Supervisory Board members | ||

|---|---|---|---|---|---|

| Total amount of compensation paid | Bonus | Stock-based remuneration | |||

| Directors (excluding outside directors) | 544 | 350 | 141 | 52 | 8 |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members) | 34 | 34 | - | - | 2 |

| Outside directors and outside Audit & Supervisory Board members | 166 | 166 | - | - | 11 |

- 1The above table includes one Director and three Audit & Supervisory Board Members(two Outside Audit & Supervisory Board Members)who retired at the conclusion of the 17th Ordinary General Meeting of Shareholders held on March 28, 2023.

- 2The basic compensation for Directors was set to be an annual amount within ¥900 million including bonuses (including within ¥100 million for Outside Directors) at the 16th Ordinary General Meeting of Shareholders held on March 25, 2022, and the number of Directors as of the date of such resolution was twelve (12) (including five (5) Outside Directors).

- 3The basic compensation for Audit & Supervisory Board Members was resolved at the 16th Ordinary General Meeting of Shareholders held on March 25, 2022 to be an annual amount within ¥140 million, and the number of Audit & Supervisory Board Members as of the date of such resolution is five (5).

- 4Bonus and Stock-based compensation are performance linked compensations. Stock-based compensation is non-monetary compensation.

- 5The Company resolved to introduce stock-based compensation system for Directors and Executive Officers (the Board Incentive Plan Trust) at the 12th Ordinary General Meeting of Shareholders held on June 26, 2018. The stock-based compensation figures in the table above represent the fees incurred with regard to the stock-based points assigned to Directors in the year ended December 31, 2022 concerning the Board Incentive Plan Trust. At the 16th Ordinary General Meeting of Shareholders held on March 25, 2022, the maximum amount of money to be contributed by the Company in one (1) fiscal year was revised to ¥434 million and the maximum amount of points granted in one (1) fiscal year to those eligible for the system was revised to 806,000 points (equivalent to 806,000 shares of the Company), and the number of Directors (excluding Outside Directors and non-residents in Japan) as of the date of such resolution is seven (7).

[Resolutions of the Company regarding the Development of the Systems for Ensuring Proper Operations (Internal Control Systems)]

The following is a summary of the resolutions of the Company, regarding the "Development of the Systems for Ensuring the Proper Operations as a Stock Company (Internal Control Systems)."

Systems to Ensure that Directors and Employees of the Company Execute their Duties in Compliance with Laws and Regulations and the Articles of Incorporation

To ensure that Directors and employees of the Company execute their duties in compliance with applicable laws and regulations and the Articles of Incorporation, the Company shall develop a Sustainability Principles and Business Principles and establish a system to ensure complete compliance. The Company shall establish a Compliance Committee consisting of the director in charge of compliance and the head or the director in each division, etc., to deliberate basic policies or other important matters related to compliance. By monitoring the implementation of such policies and ensuring thorough dissemination through in-house training, etc., the Company ensures that its Directors and employees comply with laws and regulations and the Articles of Incorporation in the execution of their duties. Furthermore, the Company shall establish an internal whistle-blowing system with a department in charge and external experts (lawyers) as providers of consultation services.

In order to ensure effective compliance systems and relevant internal rules, the Company shall also verify and evaluate such systems and make the necessary improvements through audits, etc., carried out by the internal audit division, which reports directly to the President & CEO and other related in-house departments or external experts. Based on the internal audit regulations, the internal audit division, which reports directly to the President & CEO, shall prepare an internal audit plan for each fiscal year, and regularly report this plan and the results of internal audits to the Board of Directors, full-time Audit & Supervisory Board Members and the Audit & Supervisory Board.

Furthermore, the Company shall develop a system to ensure the accuracy and reliability of financial reporting, and employ such system properly while evaluating its effectiveness.

Systems for the Storage and Management of Information Related to the Execution of Duties by Directors of the Company

In accordance with applicable laws and regulations, the Articles of Incorporation and internal rules, among others, the Directors shall develop a system for information security administration, and appropriately store and manage documents and other information related to the execution of their duties.

Rules and Other Systems for Risk Management of the Company

To manage diverse risks related to the INPEX Group’s business activities, Directors shall cooperate closely with the related departments to identify, analyze and evaluate such risks, and manage them in accordance with internal rules and guidelines, etc.

Furthermore, the functioning and other aspects of the risk management related to daily operations shall be verified and evaluated through audits, etc., carried out by the internal audit department under the direct control of the President & CEO of the Company and other related in-house departments or an external expert, and continually reviewed in response to changes in the business environment.

Systems to Ensure the Efficient Execution of Duties by Directors of the Company

In order to ensure that the systems to execute Directors’ duties efficiently are in place, the Directors shall manage business operations with particular attention to the following:

- 1.With regard to certain major corporate decisions, an Executive Committee meeting attended by full-time Directors, Managing Executive Officers, etc. shall be held weekly and as necessary to ensure that the duties are executed promptly and properly.

- 2.With regard to the execution of daily duties, the authority of the President & CEO shall be delegated in accordance with the Board of Directors’ Regulations and other internal regulations, and the persons in charge at each level shall execute their duties promptly.

Furthermore, the Board of Directors shall formulate the long-term management strategies and medium-term management plans, and receive progress reports on the plans and targets. The Company has adopted a divisional system and assigns Directors as the head of each division in order to achieve the efficient management of business operations and establish a structure of accountability. Each division shall implement initiatives positioned as important business milestones reflecting the business environment, while taking into account important risks and their countermeasures, so as to realize goals in the business plan and other targets. The Executive Committee shall receive progress reports on the plans and targets.

Systems to Ensure the Proper Operations of the INPEX Group

- 1.Systems for Reporting the Company Matters Related to the Execution of Duties by Directors or Other Equivalent Managerial Staff (hereinafter "Directors, etc.,") of the Company’s Subsidiaries

In accordance with the internal rules on group management, the Company shall enter into agreements regarding group management with its subsidiaries, under which the Company requires that important matters of each subsidiary shall be reported to and approved by the Company.

- 2.Rules and Other Systems for Risk Management of the Company’s Subsidiaries

For risk management of the subsidiaries of the Company, in accordance with the internal rules on group management, the Company shall conduct group-wide risk management via mutual cooperation with each subsidiary. Furthermore, the Company shall require its subsidiaries to cooperate in audits, etc., carried out by the internal audit department under the direct control of the President & CEO of the Company and other related in-house departments or an external expert to verify and evaluate the management of risks related to the daily operations of the subsidiaries. Based on the results of such verification and evaluation, the Company shall have its subsidiaries conduct continuous review of their risk management in response to changes in the business environment.

- 3.Systems to Ensure the Efficient Execution of Duties by Directors, etc., of the Company’s Subsidiaries

To ensure the efficient execution of duties by Directors, etc., of the Company’s subsidiaries, management strategies and plans shall be shared among all the INPEX Group companies. Under the vision, the Company shall have its subsidiaries manage human resources and financial resources efficiently and manage business operations in accordance with the Company’s internal rules, etc., with particular attention to the following:

- 1.Important matters of a subsidiary of the Company shall be determined by resolution of the Board of Directors meetings of the subsidiary or by consultation among the Directors of the subsidiary.

- 2.Authority for the execution of daily duties by the Company’s subsidiaries shall be delegated based on regulations stipulating the administrative authority of subsidiaries, and the persons in charge at each level shall execute their duties promptly.

- 4.Systems to Ensure that Directors, etc., and Employees of the Company’s Subsidiaries Execute their Duties in Compliance with Laws and Regulations and the Articles of Incorporation

The Company shall establish a compliance system (including an internal whistle-blowing system) that is applied to the entire Group, and this system shall be widely deployed and disseminated to all directors, auditors and other equivalent managerial staff, as well as to employees of the Company’s subsidiaries. In cooperation with its subsidiaries, the Company shall conduct audits, etc., of the subsidiaries, carried out by the internal audit department under the direct control of the President & CEO of the Company and other related in-house departments or an external expert.

The Company shall strive to establish a system to ensure that Directors, etc., and employees of the subsidiaries execute their duties in compliance with laws and regulations and the Articles of Incorporation, and enter into agreements regarding group management with its subsidiaries in accordance with the internal rules on group management.

Matters Regarding Employees Who Assist the Audit & Supervisory Board Members of the Company with Auditing Duties in Cases Where the Audit & Supervisory Board Member of the Company Requests the Assignment of Such Employees, Matters Regarding the Independence of Such Employees from Directors of the Company and Matters Related to Ensure the Effectiveness of Instructions Given to Such Employees

The Company has set up the Audit & Supervisory Board Members’ Office as an independent organization from the business execution departments and shall deploy dedicated employees to assist the Audit & Supervisory Board Members with auditing duties in order to enhance the effectiveness of audits by Audit & Supervisory Board Members.

The employees who assist the Audit & Supervisory Board Members’ duties shall follow instructions from the Audit & Supervisory Board Members. Performance appraisals, personnel changes and disciplinary action against such employees assisting the Audit & Supervisory Board Members shall require approval of the Audit & Supervisory Board Members beforehand.

Systems for Reporting to the Audit & Supervisory Board Members of the Company

The Directors and employees of the Company, directors, auditors or other equivalent managerial staff, as well as employees of the Company’s subsidiaries, or persons who receive a report from them, shall report and provide information to the Audit & Supervisory Board Members of the Company as to the matters provided by laws and regulations, matters that might have a significant impact on the Company and its Group companies, and other matters that an Audit & Supervisory Board Member of the Company has determined to be reported to execute his/her duties.

Also, the Audit & Supervisory Board Members of the Company shall always be able to obtain business information whenever needed by attending the Board of Directors’ meetings and other important internal meetings, as well as receiving internal approval documents, etc.

Regarding the internal whistle-blowing system of the INPEX Group, the director in charge of compliance shall report to the Company’s Audit & Supervisory Board Members (full-time) swiftly as to the content internally reported by directors, auditors, other equivalent managerial staff and employees of the Group companies.

Systems to Ensure that Reporters in the Preceding Section Will Not Receive Detrimental Treatment Grounds of the Whistle-Blowing

The Company shall prohibit detrimental treatment against directors, auditors, or other equivalent managerial staff, and employees of the Group companies who reported to the Company’s Audit & Supervisory Board Members. And this position shall be disseminated throughout the INPEX Group.

Regarding the internal whistle-blowing system of the INPEX Group, in case detrimental treatment against a whistle-blower is recognized, a disciplinary action will be taken against the person who treated the reporter in such a way and the head of the department to which the person belongs, pursuant to Rules of Employment, etc.

Matters Related to Policies Concerning the Treatment of Expenses or Liabilities Incurred by the Execution of Duties by the Company’s Audit & Supervisory Board Members such as Procedures for Prepayments or the Redemption of Such Expenses

In case the Company’s Audit & Supervisory Board Members request prepayment or redemption of expenses for their execution of duties, etc., based on Article 388 of the Companies Act, the Company shall swiftly process such expenses or liabilities except in the case such expenses or liabilities are proven to be unnecessary for the execution of duties by such Auditors.

Other Systems to Ensure Effective Audits by the Audit & Supervisory Board Members of the Company

The Representative Directors of the Company shall meet regularly with the Audit & Supervisory Board Members of the Company, provide information as necessary and strive to communicate with them. At the same time, the Company shall secure opportunities for Audit & Supervisory Board Members and Outside Directors to meet regularly, and strive to enhance their mutual cooperation and information sharing.

The Company shall also improve the effectiveness of audits by establishing a system, etc., whereby the Audit & Supervisory Board Members can cooperate with the internal audit department and receive reports regularly.

Furthermore, to conduct audits by the Audit & Supervisory Board Members, the Company shall ensure close cooperation between the Audit & Supervisory Board Members and external experts such as lawyers, certified public accountants and certified tax accountants, among others.

According to the stipulations of the Articles of Incorporation, INPEX issues a Class A Stock to the Minister of Economy, Trade and Industry. Unless otherwise provided by laws or ordinances, the Class A Stock does not possess voting rights at shareholders’ meetings. However, it is possible for the holder of the Class A Stock to exercise veto rights for certain major corporate decisions. We believe the holding of Class A Stock by the Minister of Economy, Trade and Industry will help prevent any incidence of unusual management, allow INPEX to stably supply energy as a core company for Japan’s oil & gas E&P and ensure that the Company does not incur any negative impact from a speculative acquisition or an attempt at management control through foreign capital. On this basis, INPEX’s role is assured. Furthermore, we expect positive results in terms of external negotiation and credits as a national flagship company efficiently contributing to the stable supply of energy in Japan.

Stock Data

(As of December 31, 2023)

| Authorized shares | |

|---|---|

| 3,600,000,000 shares | |

| 1 Class A Stock | |

| Total Number of Shareholders and Issued Shares | |

| Common shares | 292,163/1,386,667,167 shares |

| Special-class share | 1 shareholder (Minister of Economy, Trade and Industry) / 1 share |

INPEX is systematically developing a compliance structure—an indispensable requirement for its sustainable development—and strives to ensure compliance with laws and regulations and adherence to corporate ethics. Specifically, we have established the Compliance Committee, which formulates basic policies and plans pertaining to compliance, deliberates significant matters, monitors the effectiveness of compliance-related regulations, and supervises the implementation of compliance programs to promote unified compliance initiatives throughout the INPEX Group. The committee also develops and revises compliance-related rules.

In addition, under the Sustainability Principles, we have established the INPEX Group Code of Conduct, which defines the practices to be followed to ensure compliance and thereby supports observance of the Business Principles that guide how we conduct our business. We are also working to raise awareness of compliance among our executives and employees. The Business Principles and Code of Conduct were established by respective resolutions of the Compliance Committee and the Board of Directors, and are continuously reviewed in light of changes in the external environment and legislative requirements.

Compliance System

To improve the transparency of management and the accountability of managers, we conduct timely, appropriate and fair disclosure of information through our Web site, public relations activities and IR activities toward shareholders and investors.

1. To invigorate the general meeting of shareholders and promote effective voting

| Supplementary explanation | |

|---|---|

| Early delivery of convocation notices for the general meeting of shareholders | The Convocation Notice for INPEX’s 18th Ordinary General Meeting of Shareholders held on March 26, 2024 was posted on the Company’s Web site more than three weeks prior to the meeting on February 26, 2024. The Convocation Notice itself was dispatched on March 4, 2024. |

| Use of voting rights through the Internet | We implemented the use of voting rights via the Internet. We also adopted a platform for the electronic use of voting rights. |

| Others | The convocation notice and other related documentation are available in both Japanese and English on our company’s Web site and TDnet. On the day of the shareholders’ meeting, we used videos and a slide show to explain our business before opening the meeting. |

2. Enhancing IR Activities

| Supplementary explanation | Explanation by representative: Yes/No | |

|---|---|---|

| Regular Investor Briefings for Individual Investors | Investor briefings for individual investors are held regularly. (Either virtually or in-person depending on the circumstances) | Yes |

| Regular Investor Briefings for Analysts and Institutional Investors | The Company holds biannual financial results meetings with Japanese and English simultaneous interpretation for foreign and domestic analysts and institutional investors covering topics ranging from financial results to financial forecasts. (Meetings are held in-person and via live streaming at the same time) Archived videos of the meetings are viewable on the IR section of the Company’s website both in Japanese and in English after the meeting. In addition to the aforementioned meetings, the Company situationally holds Investor Days for foreign and domestic analysts and institutional investors covering its business activities and other topics. | Yes |

| Regular Investor Briefings for Overseas Investors | The Company undertakes overseas IR road shows in the regions including Europe, North America and Asia, while participating in conferences and engaging in one-on-one meetings as necessary. (Either virtually or in-person depending on the circumstances) | Yes |

| IR materials available on Web site |

Following materials in principle are posted on the IR section of the Company’s website. Furthermore, efforts are made to disclose pertinent information such as the latest news releases, the Company’s performance and financial position, as well as trends of crude oil prices, foreign currency exchange rates, the Company’s share price and stock information.

|

Yes |

Disclosure Policies

To achieve the appropriate disclosure of information, we have established internal regulations for corporate information disclosure and defined the process for collecting, managing, transmitting and disclosing information throughout our company. A summary of disclosure and other policies based on the aforementioned regulations is listed. Please refer to Disclosure Policy for further details.

1. Policy Concerning Cross-Shareholdings

The Company assessed whether or not to hold each individual cross-shareholding by comprehensively examining the purpose of the cross-shareholding, dividend income, current transactions with the company, medium-to long-term opportunities for expanding transactions, business synergies and risks, etc., while considering the Company’s cost of capital. The Company confirmed that it will consider selling shares for which the Company assessed the necessity to hold has decreased.

2. Voting rights as to the cross-shareholdings

With respect to the voting rights as to the cross-shareholdings, the Company shall determine the matters to be confirmed for each proposal to shareholders, such as appropriation of surplus, election and compensation of officers, and company reorganization. Decisions whether or not to approve proposals shall be made after full consideration of the appropriateness of the proposals and whether they will contribute to the purpose of the cross-shareholdings and the sustainable growth and increased corporate value over the mid- to long-term of the companies invested in.

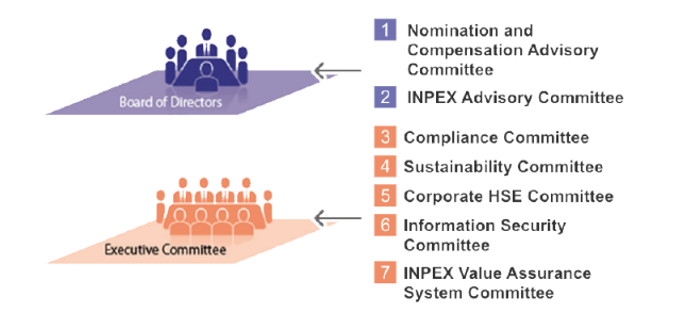

With the aims of regularly verifying that the Board of Directors is functioning appropriately and identifying issues to resolve for continuing improvement, the Company undertakes an evaluation of the effectiveness of the Board of Directors each year, and discloses the summary of the evaluation results. Based on this policy, the ninth evaluation was conducted in FY2023. The evaluation method and summary of the results are as follows.

The third-party evaluation organization has concluded that the Board of Directors secretariat has appropriately consolidated and analyzed the results of the evaluation, and that the action plans presented above, drawn from these results and analysis, have been suitably established.

Based on these evaluation results, the Company will continue striving to improve the effectiveness of the Board of Directors.

For details of the summary of evaluation results of effectiveness of the entire Board of Directors, please see the Company's website.