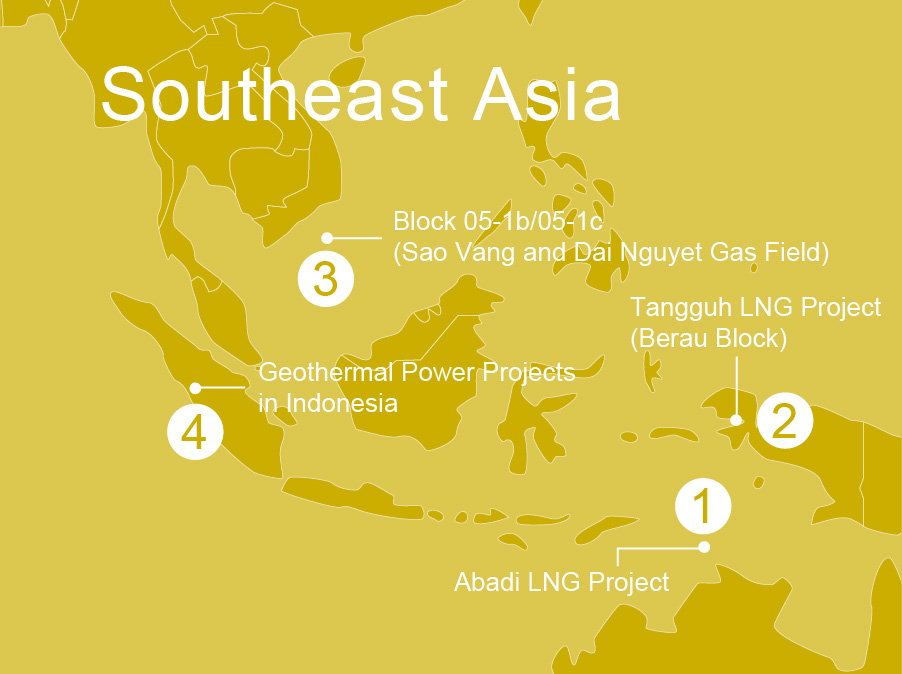

Southeast Asia

Main projects

Abadi LNG Project

| Contract area (block) |

Project status | Venture company (established) |

Interest owned (*Operator) |

|---|---|---|---|

| Masela | Preparation for development | INPEX Masela, Ltd. (December 2, 1998) |

INPEX Masela* 65% Pertamina 20% Petronas 15% |

The Abadi LNG Project is based on an onshore LNG development scheme that INPEX as the operator is preparing for development in the Masela Block offshore Indonesia. The project is expected to produce approximately 9.5 million tons of LNG per year and up to approximately 35 thousand barrels of condensate per day. The project will also supply 150 million cubic feet of natural gas per day via pipeline to address local demand for natural gas. INPEX acquired a 100% interest in the Masela Block in November 1998 through an open bid conducted by the Indonesian authorities. INPEX subsequently conducted exploration activities as the operator, discovering the Abadi Gas Field through the first exploratory well drilled in 2000. Following exploration, evaluation activities and development studies, INPEX conducted Pre-FEED work from March to October 2018 based on an onshore LNG development scheme envisaging an annual LNG production capacity of 9.5 million tons. INPEX submitted a revised plan of development in June 2019 and received approval from the Indonesian authorities in July 2019. Alongside the approval of the revised development plan, the Indonesian authorities also approved an extension of the term of the Masela Block Production Sharing Contract (PSC) until 2055. Detailed survey work in the planned construction site for the LNG plant and its surrounding areas had been underway until it was suspended due to the impact of the COVID-19 pandemic. Subsequently, considering the need to contribute to a net zero carbon society and aspiring to make the project cleaner and more competitive amid energy transition, INPEX has been consulting with the Indonesian authorities on a revised development plan introducing CCS and submitted that plan to the authorities in April 2023. INPEX is currently working toward making the FID in the latter half of the 2020s and commencing production in the early 2030s.

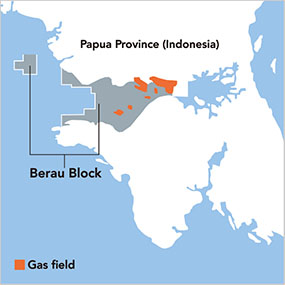

Tangguh LNG Project (Berau Block)

| Contract area (block) |

Project status | Production volume** | Venture company (established) |

Interest owned (*Operator) |

|---|---|---|---|---|

| Berau | In production | Crude oil: 6 Kbbld Natural gas***: 1,145 MMcf/d |

MI Berau B.V. (August 14, 2001) |

Ml Berau 22.856% BP* 48.0% Nippon Oil Exploration (Berau) 17.144% KG Berau 12.0% |

| Tangguh Unit | MI Berau 16.3% BP* 40.22% CNOOC 13.9% Nippon Oil Exploration (Berau) 12.23% KG Berau 8.56% LNG Japan 7.35% KG Wiriagar 1.44% |

- **Daily production volume on the basis of all fields and average rate of fiscal year ended December 31, 2022

- ***Not the volume at wellheads but corresponds to the gas volume sold to buyers

MI Berau B.V., jointly established by INPEX and Mitsubishi Corporation, acquired an interest in the Berau Block in October 2001. In October 2007, MI Berau Japan Ltd., also a joint venture with Mitsubishi Corporation, acquired a stake in KG Berau Petroleum Ltd., effectively increasing INPEX’s interest in the Tangguh LNG Project to around 7.79%. In March 2005, Indonesian authorities approved an extension of the PSC and project development plans for the Tangguh LNG Project until 2035. Following development work, the first shipments of LNG began in July 2009. The FID to expand the Tangguh LNG Project was made in July 2016. The Tangguh LNG expansion project will add a third LNG processing train, which is currently under construction, with production capacity of 3.8 million tons per annum, to the existing two trains with production capacity of 7.6 million tons per annum. In addition, CCUS is planned to be introduced in accordance with the development plan approved by SKK Migas in 2021, and this is expected to make the LNG plant one of the cleanest in the world in terms of greenhouse gas emissions. The project also obtained government approval in December 2022 to extend the term of the PSC by 20 years to 2055.

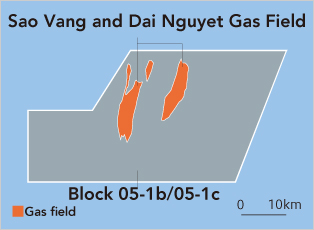

Block 05-1b/05-1c (Sao Vang and Dai Nguyet Gas Field)

| Contract area (block) |

Project status | Production volume** | Venture company (established) |

Interest owned (*Operator) |

|---|---|---|---|---|

| Block 05-1b/05-1c | In production | Natural gas: 1.5 billion m3 per year (expected) Crude oil and condensate: 2.8 million bbl per year (expected) |

Teikoku Oil (Con Son) Co., Ltd. (October 29, 2004) |

Teikoku Oil (Con Son) Co., Ltd. 36.92% Idemitsu Gas Production (Vietnam) Co., Ltd.* 43.08% Vietnam Oil and Gas Group (PetroVietnam) 20% |

- **Production on the basis of all fields

In 2004, INPEX acquired Blocks 05-1b and 05-1c, located 350 kilometers southeast of Ho Chi Minh City, Vietnam. In 2010, an exploration well was drilled in the Dai Nguyet (DN) structure leading to the discovery of gas and condensate accumulations. In 2014, another exploration well was drilled in the Sao Vang (SV) structure, which also led to the discovery of gas and condensate accumulations. In 2017, a development plan for the SV/DN gas field was approved by the Vietnamese government, and production commenced at the Sao Vang Gas Field in 2020, followed by the Dai Nguyet Gas Field in 2022.

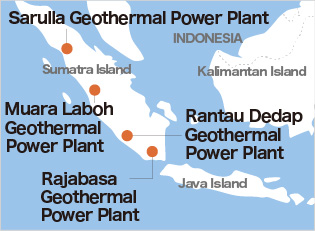

Geothermal Power Projects in Indonesia

| Contract area (block) |

Project status | Venture company (established) |

Generation capacity | Interest owned (*Operator) |

|---|---|---|---|---|

| Muara Laboh Geothermal Power Project | In commercial operation | INPEX GEOTHERMAL, LTD. (May 26, 2021)) | 85 MW | PT Supreme Energy Muara Laboh* (Share owned: INPEX GEOTHERMAL 30% Sumitomo Corporation 50% PT Supreme Energy 20%) |

| Rantau Dedap Geothermal Power Project | 98.4 MW | PT Supreme Energy Rantau Dedap* (Share owned: INPEX GEOTHERMAL 27.4% Marubeni 27.4% Tohoku Electric Power 20.0% PT Supreme Energy 25.2%) |

||

| Sarulla Geothermal Power Project | INPEX Geothermal Sarulla, Ltd. (April 1, 2014) | 330 MW | Sarulla Operations Ltd.* (Share owned: INPEX Geothermal Sarulla 18.2525% Kyushu Electric Power 25% Itochu 25% Medco Energy International 18.9925% Ormat Technologies 12.75%) |

|

| Rajabasa Geothermal Power Project | Under exploration | INPEX GEOTHERMAL, LTD. (May 26, 2021) | - | PT Supreme Energy Rajabasa* (Share owned: INPEX GEOTHERMAL 31.50% Other 68.50%) |

In geothermal power generation, the thermal energy of underground magma is used to create steam to power turbines and generate power. INPEX has joined four geothermal power projects (Muara Laboh, Rantau Dedap, Sarulla and Rajabasa) located on Sumatra Island, Indonesia. Among these, the Muara Laboh Geothermal Power Project, Rantau Dedap Geothermal Power Project and Sarulla Geothermal Power Project, are in commercial operation. Combined, these projects provide a generation capacity of approximately 513 megawatts, an output equivalent to what is consumed annually by the approximately 2.9 million households in Sumatra, Indonesia. Electricity generated by the plants using geothermalresources is planned to be marketed to Indonesian national power company PT PLN (Persero) over the period of about 30 years from the start of commercial operation. For the Rajabasa Geothermal Power Project, which is still in the exploration stage, surface and geophysical surveys have indicated a certain potential for geothermal resources. If sufficient geothermal resources are located through exploration activities to warrant the development of the Project, this is expected to contribute to the further expansion of INPEX’s geothermal business in Indonesia.